Why Bell’s Bid to Buy MTS is Bad News

Last week, BCE announced its $3.9 billion bid to acquire MTS, the incumbent wireless, internet and IPTV provider in Manitoba. BCE’s share of revenue (28%) across the telecoms-internet and media landscape is already close to double that of Rogers (16.3% market share) and Telus (15.9%). Approving this deal would only further gird Bell’s place at the apex of the Canadian communication system.

Blessing the deal would also be at cross-purposes with findings by the CRTC and Competition Bureau on several occasions last year that telecoms and TV markets in Canada are highly concentrated, while turning a blind eye to the anti-competitive behaviour that led to those findings. The number of mobile wireless competitors in Manitoba would also drop from four to three as a result, effectively putting a stake through the last government’s policy of promoting four wireless carriers across the country.

Of course, there is no need for the new Liberal Government to keep a policy created by its predecessor, but it would be well-advised to consider the real benefits of keeping this policy (see the OECD’s review for why this is so). Finally, and this is key to the analysis that follows, what if, contrary to the claims of the deal’s backers, MTS has maintained low prices while achieving profit levels and making substantial capital investment in 4G mobile wireless, fibre-to-the-doorstep and competitive TV services?

Do Low Prices Amount to a Short-Sighted Race to the Bottom and Low Quality Network Infrastructures?

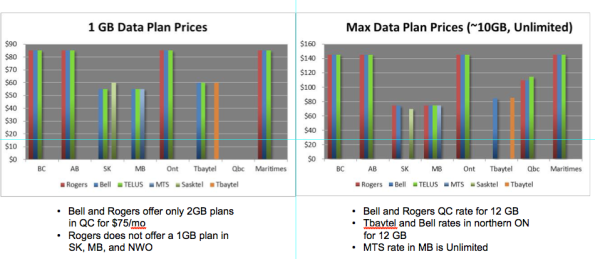

So far several commentators have raised the alarm that a takeover of MTS will drive up prices as Bell, Rogers and Telus assert their dominance in Manitoba in a manner all to familiar to other regions across the country (Geist and Blackwell). Such a prospect turns on the fact that already Bell, Rogers and Telus price their plans $30 to $70 less than their equivalent offerings in Ontario, Alberta and BC to meet the rates charged by MTS and SaskTel in Manitoba and Saskatchewan, respectively. Figure 1 below illustrates the point.

Figure 1 Retail Wireless Plan Prices by Province (September 2014).

Source: MTS, SaskTel & tbaytel (2015). Telecom Notice of Consultation CRTC 2014-76 Review of Wholesale Mobile Wireless Services (para 25).

According to Bell and MTS, however, the deal is not about maintaining cheap but lower quality services at all. Instead, it is about bringing MTS out of the dark ages and into the future with an ambitious billion dollar investment program spread over five years to bring state-of-the-art fibre optic networks in Manitoba, increase the reach of Bell’s “world class” Fibe TV service, and to expand wireless 4G LTE network coverage in the province (BCE, Analyst Presentation, 2016, p. 6).

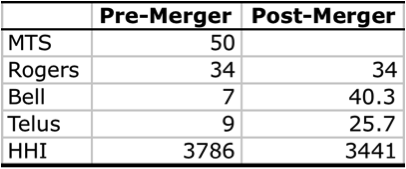

BCE’s CEO George Cope has been keen to emphasize that the market might become even more competitive after the deal. As he sees it, there will be three large firms competing even more aggressively after the deal than the current situation where MTS rules the wireless market with over half of all subscribers followed by Rogers with a third of the market share, trailed far behind by Telus (9%) and Bell (7%) (based on 2014 figures) (CRTC, 2014, unpublished data; also MTS, 2014 Ann Rpt, p. 7).

The intensification of “sustainable competition” would be especially likely, it is claimed, after Bell divests one-third of MTS’s wireless subscribers to Telus, as the deal envisions, according to Cope. The upshot is that instead of two strong competitors, MTS and Rogers, followed in the distance by Telus and Bell, there will be three “strong players”. Table 1 below shows the pre- and post-merger results.

Table 1: Mobile Wireless Carriers’ Market Shares in Manitoba Pre- and Post-Merger

Source: MTS (2015). Annual Report 2014, p. 7.

According to this view, this is how dynamic competition works. Big players with deep pockets, staying power and know-how compete vigorously with one another on the frontiers of technological and service innovation rather than on the basis of “unsustainable price rivalry”. Regulatory economist Gerry Wall also chimed in to support this line of argument, telling the National Post that while MTS wireless pricing “forced the Big Three to match [its] low prices”, such a strategy is “unsustainable”. As Wall further added:

The aggressive pricing strategy has been successful in terms of keeping customers but I think it has taxed them financially – and the investment required for 4G and next gen networks is very challenging (quoted in Corcoron, 2016, “Good Riddance to Fourth Carriers”).

In simple terms, to focus on cheap prices now might sell Manitobans down the river in the long-run if MTS is not making enough money to build the infrastructure needed to support the province in the 21st Century. These are serious issues indeed, but are they right?

I don’t think so. In fact, as we will see below, while prices are low in Manitoba compared to much of the rest of the country, profits and capital investment at MTS are actually higher than Bell’s.

Why Even Imperfect Competition is Better than a Tight Oligopoly

BCE’s bid for MTS must obtain the blessing of three regulators: Innovation, Science and Economic Development (ISED, the recently renamed Industry Canada), the Competition Bureau and the CRTC. One of BCE’s main claims in favour of the deal is that it holds forth the prospect for sustainable competition if given the green light by regulators. Seeming to recognize that this is not a slam dunk, BCE and MTS expect the review process to take up to a year.

On the basis of the standard tools typically used to examine these things – i.e. Concentration Ratios (CR) and the Herfindhahl–Hirschman Index (HHI) – the case is doubtful. In terms of the CR measure, we will go from a situation where the top four firms control 100% of the market to one where three firms will do so.

While the distribution of market shares of Bell (40%), Rogers (34%) and Telus (26%) (see Table 1 above) that will result should the deal be approved does tally with Bell’s view of things, the HHI – which is specifically designed to assess competitive intensity – tells a different story. The HHI score will decline from 3786 to 3441, but the more urgent point is that this still indicates skyhigh concentration levels. Indeed, any result over 2,500 indicates extremely high levels of market concentration. This deal will do nothing to change that.

Even these points underplay the extent to which consolidation dynamics will likely be ramified by BCE’s takeover of MTS. For instance, while Bell presents its plan to divest a third of MTS subscribers to Telus as a magnanimous gesture intended to mollify regulators, this ignores the fact that the two have had a network sharing deal that covers the province since 2001 (see Klass, 2015).

Furthermore, Bell’s takeover of MTS could leave Rogers out in the cold given that it and MTS have paralleled Bell and Telus to build jointly-shared networks of their own. MTS and Rogers first joined forces in 2009, for instance, to build a shared HSPA+ mobile wireless network in Manitoba. Similar arrangements were struck again in 2013 to build a shared LTE network; in fact, before the takeover was announced, MTS already had plans in place to cover more than 90 per-cent of Manitoba’s population with 4G LTE wireless service by 2018 (MTS, 2013 AR, p. 12).

Where Rogers will stand once that agreement comes to an end, however, has so far gone unspoken. If Rogers is left out in the cold, then the circumstances will be worse than ever, with not even a full duopoly left, given Bell and Telus’ shared interests in the province. However, even if Rogers is taken care of, so to speak, the cozy oligopoly that now straddles much of the land will only be reinforced.

That already very high levels of concentration exist and could get worse is not a mystery. As Eli Noam (2013) observes, concentration levels around the world for these markets tend to be “astonishingly high” (p. 8).

What has made the difference is regulators willing to face up to such realities and deal with them accordingly. And a key element in such responses has been the adoption of fourth wireless carrier policies. Of course, there is no magic number in terms of how many players a market can sustain but experience shows that a fourth competitor helps to break dominant players’ tendency to fly as a flock in markets defined by a tight oligopoly.

The advent of four or more rivals, in turn, results in more competitive retail pricing as well as more robust wholesale access regimes and a virtuous circle of more competitors, greater pricing diversity and the advent of mobile virtual network operators, for instance – all of which helps to breakdown barriers to adoption. This is especially important in Canada with respect to mobile wireless services, where it ranks 32nd out of 40 OECD and EU countries (see Broadband Wireless Penetration sheet)

Moreover, the pursuit of the “fourth competitor” policy is far from being just a populist ploy, as some critics grouse. Indeed, with communication costs a key part of doing business within Canada and around the world, businesses are pushing for lower wireless and broadband internet prices. This is why such issues are pressing more urgently not just on Canadian policy-makers and regulators but also their international counterparts at the OECD and WTO as well (OECD, 2013, p. 21).

Profits @ MTS are High, Not Low

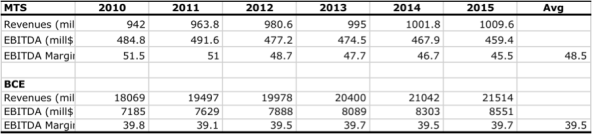

Claims that competition and low prices have been artificially sustained in Manitoba collide with the reality that profits at MTS are very high, not low, and much higher than BCE’s actually. Bell itself noted the point in its presentation to analysts, suggesting that MTS EBITDA rates were comparable to its own, i.e. in the 40% range (BCE, Analyst Presentation, 2016, p. 5).

However, even that low-balls the state of affairs. As a matter of fact, EBITDA at MTS has been considerably higher than those at BCE for the past six years for which data was examined. Table 2 below illustrates the point.

Table 2: Revenue and EBITDA @ MTS vs BCE, 2010-2015

Sources: Company Annual Reports.

In short, MTS has maintained low prices while achieving profit levels that are even higher than those of BCE. The same story holds for capital investment.

Capital Investment @ MTS is Not Low but Higher than BCE’s

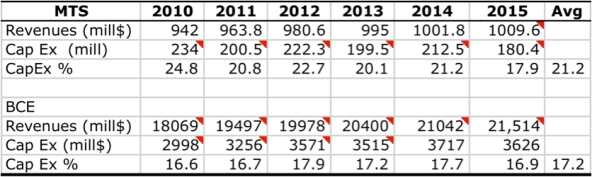

To hear BCE boss George Cope and MTS’s CEO Jay Forbes tell it last week, MTS is starving for investment capital because cheap prices have led to low profits. Consequently, MTS is at risk of falling behind when it comes to upgrading the information infrastructures that Manitobans will need to survive and thrive in the 21st Century.

The very high levels of profit – by the standards of BCE, the communications sector, and across Canadian industry as a whole – however, paints a very different picture. The evidence with respect to capital investment also belies the claims being touted in support of the deal. As a matter of fact, capital investment at MTS has also been higher than BCE in relative terms. Table 3 illustrates the point.

Table 3: Capital Investment @ MTS vs BCE, 2010-2015

Sources: Company Annual Reports.

MTS has been investing in the range of $200 million for the past half-decade or more. At best, BCE’s commitment to spend $1 billion over the next five years will hold the line on what MTS has been investing. In other words, the deal offers nothing better than what is currently on offer and we can only hold our breathe that BCE follows through on its pledges, but on this score, its track record does not instil confidence.

Capital Investment in 4G Mobile Wireless Services

Without taking an overly rosy view of things, MTS has made substantial capital investments in fibre-to-the-node (FTTN) and fibre-to-the-home (FTTH) networks, and to expand its 4G HSPA+ and LTE networks in cities and communities across the province. Its 4G HSPA+ and ‘true 4G’ LTE wireless networks now cover 98% and 78% of Manitoba’s population, respectively (MTS, 2015, para 20).

The latter is less than the 86% coverage that Bell has achieved in its service areas in Ontario, Quebec and the Atlantic region (BCE, 2015, p. 10), but this reflects two things: first the more rural and dispersed nature of Manitoba’s population and, second, the fact that the deployment of new networks takes place in “step changes”, with early leads typically being transitory. In any case, the gap that currently exists will likely narrow during the next 18-24 months as MTS reaches its goal of 90% population coverage by 2018 (MTS, 2013 AR, p. 12). To the extent that this falls short of BCE’s aim for 98% coverage, BCE has not included any targets beyond those MTS has already made in its takeover bid.

If there’s any question about the quality of MTS’s LTE network, such concerns can also be allayed by its first place ranking by PCMag.com in 2013. Moreover, its network sharing deal with Rogers also allows it to obtain access to wireless devices that might otherwise be hard to get for smaller scale carriers like itself (MTS, 2014 AR, p. 6).

Leaders and Laggards and a World Turned Upside Down to Sell a Dubious Deal

Wireless investment is one thing, but MTS’s investment in highspeed broadband networks has been greater than Bell’s for years. Indeed, the irony of the deal now being pitched is that the laggard (Bell) seeks to take over the leader (MTS) when seen from the vantage point of broadband internet development in general, and fibre-optic based networks in particular.

In terms of residential broadband internet availability, for example, 95% of Manitobans have access to basic broadband from MTS at 5 mbps – the current broadband target set by the CRTC in 2011 — a figure that compares favourably with Bell in Quebec and Ontario (94% and 97%, respectively) but which is higher than in the Atlantic provinces, where access to 5 Mbps broadband ranges from 77% in PEI to 90% in NB (CRTC, 2014 CMR, Figure 2.0.5).

Turn our attention to more advanced fibre-based networks to the neighbourhood and the premise, and services that run overtop of these networks, notably IPTV, however, and the advantage tilts significantly in MTS’s advantage.

MTS began to roll out such services in 2003 and within a year the number of IPTV subscribers began to take off. Now, 70% of households in Manitoba have access to its IPTV service – Ultimate TV — and with internet speeds up to 50 Mbps, while FTTH is available in sixteen communities (MTS, 2014 AR, p. 12).

In contrast, Bell only began to deploy such services first in the Atlantic Provinces in 2009, followed a year later in Ontario and Quebec. Bell boasts that 7.5 million businesses and homes currently have access to its FTTN or FTTH network (Bell, 2015 BSO Submission, para 39), and that its Fibe TV is available to 6.2 million households (BCE, 2015 AR, p. 32).

These numbers may appear impressive at first blush but reconcile them with Statistics Canada data on the number of businesses and residential households in Bell’s service areas and a different picture takes shape: i.e. only about 60% of all households have access to Fibe TV, while less than two thirds of residential households and businesses have access to the company’s FTTN and FTTH network. In short, Bell was slower off the mark than MTS and continues to lag behind in terms of the uptake of these services. Table 4 below illustrates the pint. .

Table 4: IPTV Subscribers, 2004-2014

Sources: Company Annual Reports.

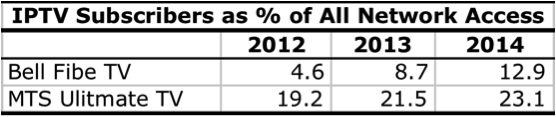

The uptake of the MTS’s Ultimate TV IPTV services has also been swifter than the take-up of Bell’s Fibe TV in its territory. Indeed, as Table 5 below illustrates, the take-up of MTS’s Ultimate TV is nearly twice that of Bell.

Table 5: IPTV Subscribers/Total Network Access Connections, MTS vs Bell, 2012-2014

Sources: Company Annual Reports.

Small Cable Packages, Pick & Pay TV and Consumer Choice: MTS Subscribers are Already There

The fact that IPTV take up in Manitoba is high compared to the standards that prevail in Bell’s operating areas reflects the broader fight that has been taking shape over “cable TV” during the past decade. Indeed, the conservative versus more progressive views of Bell and MTS, respectively, also comes into focus when we look closer at their respective approaches to TV.

In this regard, Bell, the largest vertically-integrated telecoms-internet and media conglomerate in the country, and the biggest force in TV by far (61 TV channels and one-third of all TV revenue), has fought the CRTC tooth and nail over the regulator’s push to give people more choice over their cable TV subscriptions by mandating the offering of “skinny basic”, pared down channel bundles and, by the end of 2016, true ala carte channel offerings. Indeed, having banked on the vertically-integrated model through its take-over of CTV and Astral in 2011 and 2013, respectively, Bell has been loath to yield control over its TV operations.

MTS, in contrast, is not vertically-integrated, and having taken the plunge into the TV delivery business with the launch of its IPTV services since 2003-2004, it has been eager to pick up subscribers as swiftly as it can. To this end it has been successful, with twice the number of subscribers on a per capita basis as Bell (see Table 5 above). And as part of this effort, MTS has been offering smaller TV packages for several years and even some of the most popular sports channels on a pick-and-pay basis.

Thus, as the company states in its most recent Annual Report about the CRTC’s Talk TV rulings last year:

. . . Because we offer a number of services on a standalone basis today, the changes to our systems to introduce pick-and-pay by December 2016 should also be relatively simple to implement (p. 25).

Yet, while MTS has been ahead of the curve, it also notes year-after-year that access to programming, especially high-end entertainment and sports programs, has been extremely difficult. Why? Because:

Much of this content is created and/or owned by our competitors (Bell, Rogers and Shaw), who could have conflicting interests when we negotiate for their content. To date, the CRTC has offered broadcasting distributors such as MTS limited protection against attempts by our competitors who own this content (for use in both traditional television and mobile applications) to charge us unfair rates or deny us access to this content altogether (emphasis added, MTS, 2015 AR, p. 25).

In other words, the CRTC’s attempts to introduce more competition and flexibility have been met by fierce opposition from Bell, which has turned to Cabinet and the courts in a series of bids to overturn these moves. Smaller, non vertically-integrated entities such as MTS, however, have seen the regulator as offering too little, too late.

Data Caps: Hesitant Use at MTS versus Major New Revenue Stream and Broadcast TV Protection Tool @ BCE

Another significant area where MTS has distinguished itself from Bell is in the use of data caps. As MTS comments,

. . . We are the only provider in Manitoba to provide unlimited data plans. With MTS, our customers can surf, download and stream all they want on our Internet and wireless services without worrying about paying overage charges within Manitoba. Our wireless networks, coverage and experience are all built to make it easy to stay powered and connected (MTS, 2014 AR, p. 7).

At Bell, in contrast, data caps are prevalent and so-called overage charges steep. Whereas MTS has been hesitant to use data caps to limit how people use the mobile wireless and internet access they pay for, Bell uses restrictive data caps routinely as a lucrative new stream of revenue and to protect its highly leveraged investments in broadcasting from the onslaught of over-the-top streaming service such as Netflix, Spotify and so forth.

This point strikes at the heart of Bell’s bid to acquire MTS because, as the telecoms consultancy Rewheel (2015) has shown, in markets that go from 4 to 3 wireless carriers, not only do prices tend to rise steeply but data caps become smaller and the cost of data on a per GB basis far higher. BCE’s take-over of MTS threatens to take a situation that is already exceptional by international standards (i.e. the prevalence of data caps is comparable in only three other OECD countries: Australia, Iceland and New Zealand) from bad to worse.

In sum, with data caps much less common and the cost per GB much lower in Manitoba than in most of Bell’s operating territory, the potential for similar results to take hold in Manitoba are great, especially with the CEOs and financial officers of both firms openly talking about the desire to drive up ARPU at MTS.

Some Concluding Observations and Options for What Might be Done

To be sure, one has to be careful not to idealize conditions in sunny Manitoba versus those in Bell’s operating territories. Indeed, not all is just fine in Manitoba.

The CRTC’s review of basic telecommunications service, for example, heard from one intervener after another that broadband access in both companies’ operating territories leave much to be desired. Yet, neither company appears eager to rectify the situation unless a strict business case can be made to do so. Moreover, while BCE and MTS executives have waxed on at length about how to raise average revenue per user (ARPU) at MTS, they have had little to say about how rural service might be improved (BCE, Analyst Presentation, 2016, p. 6).

The contention that conditions in the province lag those in Central and Eastern Canada, however, and that Bell will ride to the rescue of a beleaguered provincial carrier down on its knees due to populist pandering through cheap services that have undercut the potential for dynamic competition and innovation over the long run, is woefully misleading. There is no evidence that competition will become more intense on account of a marriage of the two companies, especially if Bell hands off a third of MTS’s mobile wireless subscribers and retail stores to Telus. This will be doubly certain without any game plan to ensure Rogers maintains network access comparable to what it currently has in Manitoba, but even then that would do little more than keep the tight oligopoly alive, and there is little to commend such a policy.

Furthermore, there is little to no evidence of a profit crunch at MTS disabling its ability to invest substantially in the information infrastructure needed to support the Digital Economy in the 21st Century. In fact, profit and investment levels are higher at MTS than at BCE, while prices remain substantially less in Manitoba compared to BC, Alberta and Ontario where the dominance of the big three remains solid. Despite the significantly lower prices in the province, ARPU levels at MTS are consistent with those elsewhere in Canada, implying that cheaper rates are leading to more use – exactly what the aim of good communication policy should be. Any takeover of MTS by Bell would likely see such realities quickly overtaken by Bell’s preferred model where expensive prices, restrictive data caps and high ‘overage charges’ are the norm.

So, what’s to be done? From easiest to hardest, at least in terms of political will, four options seem possible. They are:

Option #1: Do Nothing

Accept the deal as proposed by Bell with the divestitures to Telus and maybe some minor tinkering around the edges.

Option #2: The OFCOM Solution

In this scenario, Canadian regulators could join forces to arrive at a solution similar to what Ofcom did in 2011 when faced by a reduction of five mobile wireless competitors to four in the UK market. In that case, when Orange (France Telecom) and T-Mobile (Deutsch Telecom), the 3rd and 4th biggest players in the market, respectively, proposed to merge in 2011, the UK telecoms and media regulator blessed their merger on the condition that the new entity – Everything Everywhere (EE) — hand over a quarter of its prized LTE/4G spectrum to the number four player, Hutchison 3. The two other largest players – Vodafone and O2 – complained bitterly, but to no avail, and with access to spectrum, towers and other resources needed to be viable, 3 stepped into the breach to become a significant 4th player in the UK market ever since.

In the present situation, Bell’s plan to divest subscribers to Telus might look good on paper but ignores their long-standing network-sharing agreement. In the eventuality that Bell does acquire MTS, steps might be taken that simultaneously prevent Rogers from being frozen out the market once its network sharing agreement with MTS comes to an end while going further to support Telus as a larger force in the province at the same time as a new 4th player is encouraged.

Yet the chance of a new 4th player emerging in Manitoba are slim given that the most likely candidates, e.g. Shaw and Wind, already showed little interest in entering the province before the latter was taken over by the former. Indications since are that their reluctance to launch in Manitoba has, if anything, hardened. Shaw, for instance, transferred the 1700 MHz AWS spectrum it acquired at discount rates in 2008 as part of the government’s bid to cultivate new entrants to Rogers in 2014, while Wind sold 15 MHz paired AWS-1 spectrum to MTS last year (MTS, AR 2015, 6).

Thus, while potentially the most interesting and earnest option on offer, the hope of keeping four players alive — the “Ofcom Solution” — is probably the most complicated and least likely to work.

Option #3: Double-down on the open access and regulated wholesale access rules while promoting Mobile Virtual Network Operators (MVNOs)

Given that the second option is unlikely to succeed, and the reasonable prospect that a combined Bell-Telus arrangement and a marginalized Rogers might lead to an even tighter oligopoly than that which already exists in much of the rest of the country – i.e. with effectively 2.5 players – regulators might double down on the CRTC’s wholesale mobile wireless ruling from last year, while expanding it to include stricter access to towers, backhaul and for MVNOs.

Strict limits on the use of data caps might also be imposed. They might even be banished for a period of time, as the FCC recently did as a condition for blessing Charter Communications’ acquisition of Time Warner Cable and Bright House Networks (see here).

Option #4: Kill the deal

If evidence and rational argument were our guiding light, then the most palatable option – but also perhaps the most politically difficult, especially given Bell’s intensive lobbying of the new government some thirty-two times in the seventeen weeks since the Liberals have been in power – would be to simply kill the deal.

With concentration levels already sky high, it would be unseemly to bless more consolidation. This is especially so with the CRTC and Competition Bureau having found on several occasions in the past year that Bell, Rogers and Telus have significant market power in the mobile wireless and wireline markets and that they have used such power to do everything they can to give new rivals a still birth. Both regulators also arrived at similar findings on the TV side as well, to which the CRTC’s series of TalkTV decisions are a response.

Without these remedies having yet had time to produce the desired results, and Bell – more than most – fighting them tooth and nail every step of the way, giving it the green light to buy MTS would be akin to blessing bad behaviour. Moreover, Bell’s attempt to tee up a take-over of MTS within this context is a sure sign of hubris, and reason enough to turn it back.

So, as I understand it, they took the OFCOM solution in the end using Xplornet. I’d be very interested in a retrospective on this given the proposed Rogers/Shaw deal!

Great read, and as someone in the industry and well aware of what is going on, I would have thought that there was another option that would make sense. An Option 2B if you will, where Bell is required to off load 33% of wireless customer to Shaw/Wind (including spectrum in Manitoba) instead of Telus. Because Rogers and Shaw are not competitors in any markets, a network sharing arrangement akin to what MTS and Rogers has today is likely, and 4 carriers would still live in the Manitoba market.

This would greatly improve competition – even more so than any other solution as it would ensure a quad-play for Shaw that can compete directly with a MTS/Bell.

If I were the CB, that is what I would be expecting…

Thanks for the comments and suggestions, Darren. And yep, Option 2B certainly sounds like a permutation of those I was putting forth that are worth considering.

Great article. However, I wouldn’t rule out Shaw from being tempted to enter the Manitoban wireless market. Both events you highlighted that would suggest they are not interested in this province happened before the acquisition of Wind by Shaw, which is a game changer here. Don’t forget Shaw has a broad cable network in Manitoba with which it could quickly roll out a wireless network at a modest price. It would also give Shaw the chance to offer 4-play bundles to their customers, which seem to be increasingly important for consumers. I think the only thing Shaw lacks to enter the wireless business in Manitoba is Spectrum, which could be transfered from BCE/MTS to Shaw, like Rogers did when they bought Mobilicity.

All very reasonable points and a scenario that should definitely be on the table.